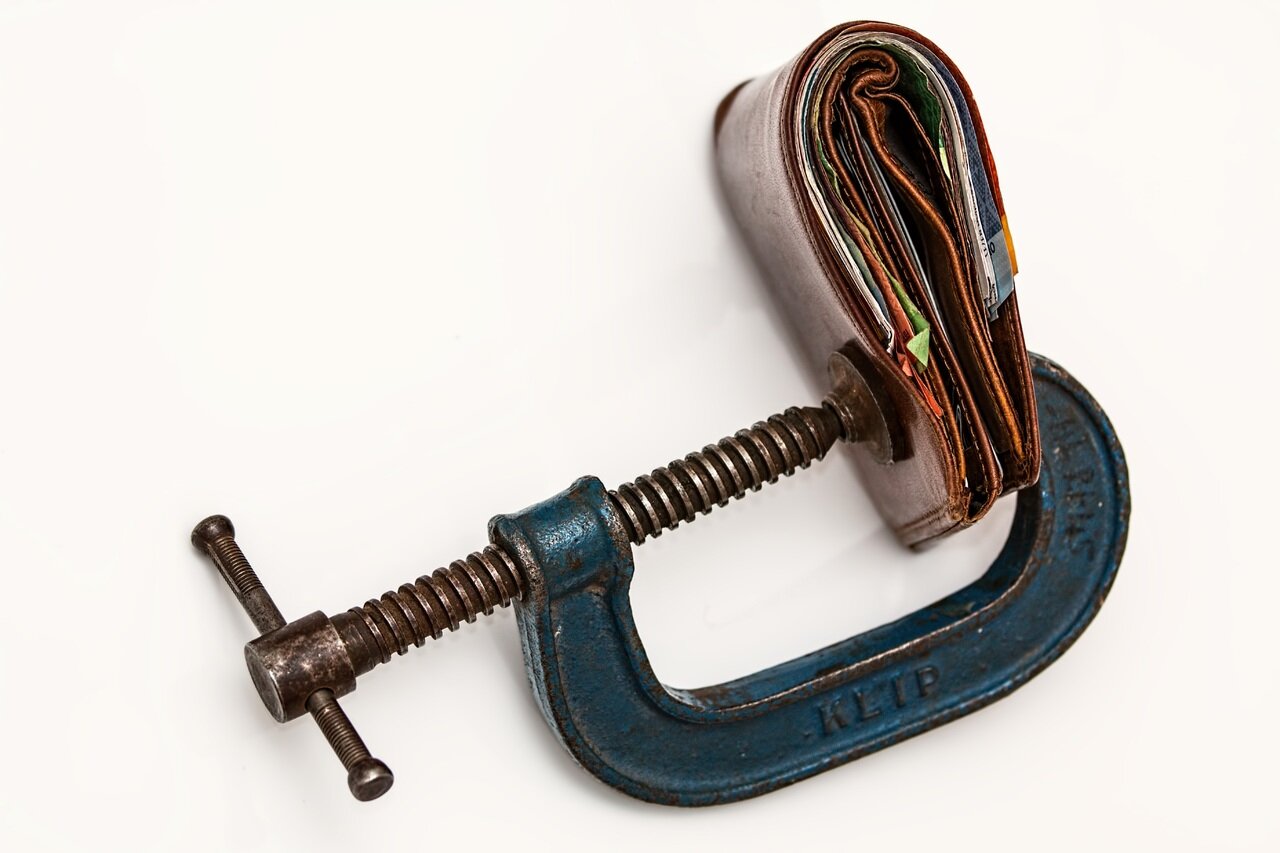

Caring For Your Wallet: 7 Ways To Reduce The Burden Of A Loan

Being in debt can get overwhelming for many people, especially if they have more than a house and car payment monthly. Sometimes, getting into debt seems so easy for many people. They may have plans to get out of it, but fail to do so in a timely manner. Fortunately, there are various options for those that find themselves in debt and don't know how to get out of it. Below are seven ways to reduce your debt so that you can start feeling better about yourself.

Consider The Loan Type

When you are in need of a loan, check out the options at King of Kash. Consider the various loans they offer, the life of the loan, and the interest it generates. Ask if there is a penalty for paying the loan quicker than what is outlined in the repayment plan.

Negotiate For Lower Interest Rates

Everything in life can be negotiated, and that even applies to loans and interest rates. Do your homework and speak with different lenders to get the best possible interest rate for the life of the loan. Lenders want your business and they will not walk away from a large loan because you are talking them down a percentage or two.

Transfer to a Loan With a Lower Interest Rate

The market changes over time and if your loan is not near what the going interest rates are now, consider moving to another lender that can offer you the lower rate. For the transfer to occur, you may have to pay a transfer fee, so it is best to weigh the cost of the loan transfer against the interest rate benefit you will receive over the life of the loan.

Repay High-Interest Loans First

For people that have various loans, they must prioritize their repayment plan. It is advised that they pay their loans with the highest interest first. Pay as much as you can to the loan that has the highest interest, without jeopardizing your ability to pay the minimum payments on the other loans you have. Once you have completely paid off the loan with the highest interest, move on to the next one.

Do Not Accrue More Debt

Do not get yourself into more debt because it will make it much more difficult to get out of it. Get rid of your credit cards or put them away somewhere so that you are not tempted to use them. This way, you will not keep adding to your financial burden.

Have an Emergency Fund

Although it is important to put as much money towards your loans as you can, having an emergency fund can help you from creating more debt. Having an emergency fund will allow you to pay for unexpected emergencies when they arise (and they always do) instead of reaching for credit cards.

Create a Monthly Budget

When you are looking to repay debt fast, you must look for extra money to put towards the loans. Prepare a monthly budget plan to see where you are spending your money. Cut out a few areas that are not necessary (like eating out or movie tickets). This can help you put more money towards the loans so that you can get out of debt faster.

Being in debt is not easy, but it is not the end of the world. Have a good plan and stick to it.